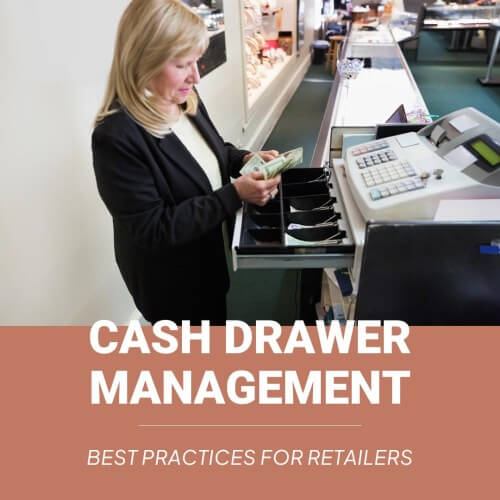

In the retail sector, where every cent counts, proper cash drawer management is essential. From small businesses to massive chains, keeping a tight ship when it comes to cash management assures seamless operations, minimizes errors, and protects against losses. In this blog, we’ll go over the fundamentals of cash drawer management and provide best practices for merchants to follow.

Establish Clear Processes: Begin by creating detailed cash handling processes that are specific to your organization. Document the steps for opening and closing the cash drawer, processing sales, executing cash drops, and reconciling cash at the conclusion of each shift or day. Ensure that all staff have received training on these procedures, and review and update them on a regular basis as appropriate.

Limit Access: Only authorized staff should be granted access to the cash drawer. Each cashier should have their own login credentials, and managers should monitor cash handling operations. Implementing user rights and monitoring staff access can help to reduce the risk of internal theft and unlawful transactions.

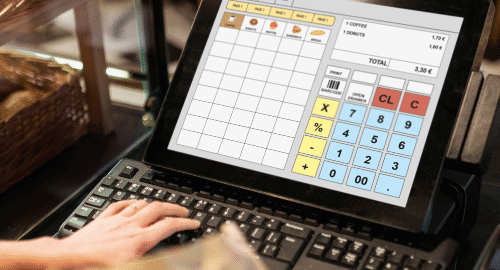

Use Technology to Your Advantage: Invest in a dependable point-of-sale (POS) system to simplify cash handling procedures. Modern POS systems not only make transactions easier, but also include features like automatic cash computations, sales reporting, and audit trails. Consider connecting your POS system with security cameras to monitor cash transactions and prevent fraud.

Implement Cash Controls: Enforce strong cash controls to reduce the possibility of errors and discrepancies. This includes keeping a predetermined beginning cash float, performing daily cash counts, and adopting dual-control processes for high-value transactions or cash drops. Consider setting cash limitations for specific transactions to decrease the danger of substantial cash losses.

Promote Accountability: By including checks and balances into your cash handling systems, you can foster an accountability culture among your team. Require staff to sign off on cash counts and transactions, conduct surprise cash audits, and swiftly investigate any inconsistencies. Holding employees accountable for their activities fosters a sense of responsibility and discourages dishonest behavior.

Secure the Cash Drawer: Keep the cash drawer closed when not in use and store it in a safe place, such as a cash office or locked cabinet. Use tamper-evident seals to prevent unwanted entry or tampering. Consider installing security cameras and alarm systems to strengthen security measures.

Frequent Reporting and Reconciliation: Arrange for routine financial reconciliations to make sure that available funds correspond to the transactions that have been documented. Reconcile on a daily or shift-end basis to find any disparities quickly. Maintain thorough records of all cash transactions, including invalid transactions, cash drops, and sales receipts. Examine cash management data to find patterns, oddities, or areas that could use better.

Remain Alert to Fraud: Keep an eye out for any fraudulent activity, including credit card scams, check fraud, and counterfeit money. Employees should receive training on identifying typical fraud schemes and how to apply verification processes to authenticate payment methods. Keep up with new developments in fraud and make necessary updates to your security procedures.

Evaluate and Enhance: Look for ways to make your cash management procedures better on a regular basis. Ask staff members and clients about their experiences with monetary transactions.

Conclusion

Evaluate the success of your cash management practices on a regular basis and make necessary adjustments to meet evolving business requirements or market trends. Retailers can reduce risks, streamline their cash handling procedures, and tightly manage their cash flow by adhering to these best practices.

Good cash drawer management increases customer satisfaction and trust while guarding against losses.