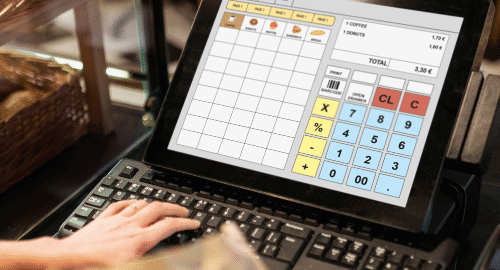

Point-of-sale (POS) machines are more than just tools for processing transactions; they’re at the heart of adapting to new payment technologies and consumer preferences. Here are five key payment trends, particularly focusing on the role of POS machines, that can help power your business in 2024.

- The Surge of Mobile Payments

Mobile payments have quickly become a preferred method for many consumers, thanks to their convenience and speed. As the market for mobile payments is expected to skyrocket from $53.5 billion in 2022 to over $607.9 billion by 2030, integrating this option into your POS system is essential. Mobile payment capabilities, such as those for Apple Pay and Google Pay, enable quick, contactless transactions that are not only faster but also cater to the tech-savvy consumer. By offering these options, you can streamline the checkout process and provide a seamless shopping experience, making it more likely that customers will return.

- Embracing Omnichannel Payment Solutions

In today’s digital age, customers expect a seamless shopping experience whether they’re online or in-store. This expectation has given rise to omnichannel payment solutions, which ensure that consumers can easily switch between different shopping channels. Advanced POS system in Kuwait now support a variety of payment methods, accommodating everything from in-store purchases to online orders and curbside pickups. Implementing such systems not only meets consumer expectations but also builds loyalty by providing a cohesive and flexible shopping experience.

- Integrating Embedded Banking Services

Embedded banking is another trend gaining momentum. This concept involves integrating banking services directly into non-banking businesses, enhancing the customer experience. For example, POS Systems that support embedded banking can offer customers instant loans or payment plans at checkout, providing convenience and potentially boosting sales. This trend opens up new revenue streams and deepens customer engagement, making your business more competitive and customer-focused.

- Enhanced Security with AI

As payment fraud becomes increasingly sophisticated, it’s more important than ever to protect both your business and your customers. AI-driven security solutions can play a crucial role in this. Modern POS Machines equipped with AI can analyze transaction patterns in real-time, flagging suspicious activities before they become significant problems. This not only protects your business from fraud but also enhances customer trust, as they feel more secure when making transactions. Investing in AI-enhanced POS systems is a smart move to safeguard your business and build a reputation for reliability.

- Adoption of Alternative Payment Methods

The payment landscape is expanding beyond traditional methods, with a growing interest in options like cryptocurrencies and Buy Now, Pay Later (BNPL) services. By integrating these alternative payment methods into your POS system, you can cater to a broader audience. BNPL options, for example, allow customers to purchase goods without paying the full amount upfront, making products more accessible and driving sales. Accepting cryptocurrencies can also attract tech-savvy customers who prefer innovative payment solutions. By embracing these alternatives, you position your business as forward-thinking and inclusive, potentially increasing both sales and customer loyalty.

Conclusion

The way businesses handle payments is rapidly changing, driven by technological advancements and evolving consumer expectations. To stay competitive, it’s crucial to integrate modern POS machines in kuwait that support a variety of payment methods, from mobile payments to cryptocurrencies. By doing so, you not only improve the customer experience but also open up new avenues for growth and revenue.